DuPage Divorce: What is Parental Alienation in Illinois law?

Many of our clients have initial questions about how the major decisions for the minor children will be made after the divorce is completed. While joint decision making is conceptually ideal, in many cases requiring the parties to make major decisions together can create disagreements, leading to further litigation. In some cases, a major decision like religion is not at issue but matters like the children’s extracurriculars and medical/dental or therapy treatments often create discord among parents. How does the Court assess whether to award a parent joint or sole decision making for the children?

The court determines whether to grant sole or joint decision-making responsibility (previously referred to as custody) for minor children based on the best interests of the child, as outlined in the Illinois Marriage and Dissolution of Marriage Act (750 ILCS 5/602.5). The court evaluates several specific criteria to decide whether one parent should have sole decision-making authority or if both parents should share joint decision-making responsibility. Below are the key factors and considerations:

The court often considers the following factors to determine what arrangement serves the child’s best interests:

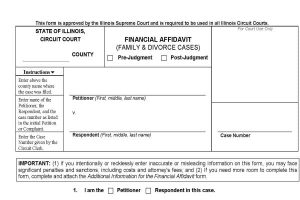

Ilyssa Panitz freely admits she gave up the financial reins when she got married.

“I did not keep an eye on the money, even though I got married later in life,” says Panitz, 54, who lives in Westchester County, N.Y. “My former spouse worked in accounting and I was taking care of the kids, and I figured ‘This is great’.”

Then, after 13 years of marriage, says Panitz, who hosts the nationally syndicated radio show, “The Divorce Hour with Illyssa Panitz,” she told her husband she wanted to split up. And she realized her ignorance about their money situation “was my biggest mistake and biggest downfall. I had the rug pulled out from under me.”

Feedspot ranks the best Divorce blogs from thousands of blogs on the web and ranked by relevancy, authority, social media followers & freshness.

Check out #22 !

It’s always interesting to read the famous Illinois Supreme Court case of In re Marriage of Bates, 212 Ill. 2d 489. As a younger lawyer I was an attorney on this case, and later was subpoenaed by the trial counsel to testify in the case as an expert knowledgeable in the field of Parental Alienation studies. This case is a landmark case in the area of Parental Alienation, as Illinois recognized Parental Alienation as a factor in a child custody decision.

—-Comments from the Court—-

“E, as proponent of the PAS testimony, proffered three expert witnesses and 136 articles from peer-reviewed publications as exhibits.